If you already think the IPVA of your expensive “popular” car, imagine paying R$ 616,500.55 only tax for owning a super sports car. In the state of São Paulo, the tax is charged IPVA 2025 starts this Monday, the 13th, and the numbers are impressive for owners of cars valued in millions. The top of the ranking belongs to Aston Martin Valour 2024, rated at incredible R$ 15.4 million.

Let's explore the context of this million-dollar tax, understand more about the vehicles on the list and reflect on the impact of IPVA for those who live in automotive luxury.

Aston Martin Valor at the Top of the Ranking

The highlight of the ranking is the Aston Martin Valor, a super limited production vehicle, with only 110 units manufactured worldwide. This exclusivity is not for nothing: the model celebrates the 110 years of Aston Martin, combining classic design with cutting-edge technology.

Common 5.2-liter twin-turbo V12 engine, Valor delivers 712 horsepower It is 753 Nm of torque, all this coupled with a six-speed manual transmission, something rare in modern supercars. This combination makes the Valour not only an engineering masterpiece, but also a visceral experience for sports car lovers.

How Much Does This Luxury Cost in Brazil?

The value of R$ 15.4 million impressive, but don't forget that, to keep it in Brazil, the owner will have to pay R$ 616,500.55 only IPVA, considering the tax rate of 4% applied in the state of São Paulo. This is equivalent to:

- 54 times the IPVA value of a popular car valued at R$ 30 thousand (IPVA of around R$ 1,200).

- More than the price of many luxury houses in Brazil.

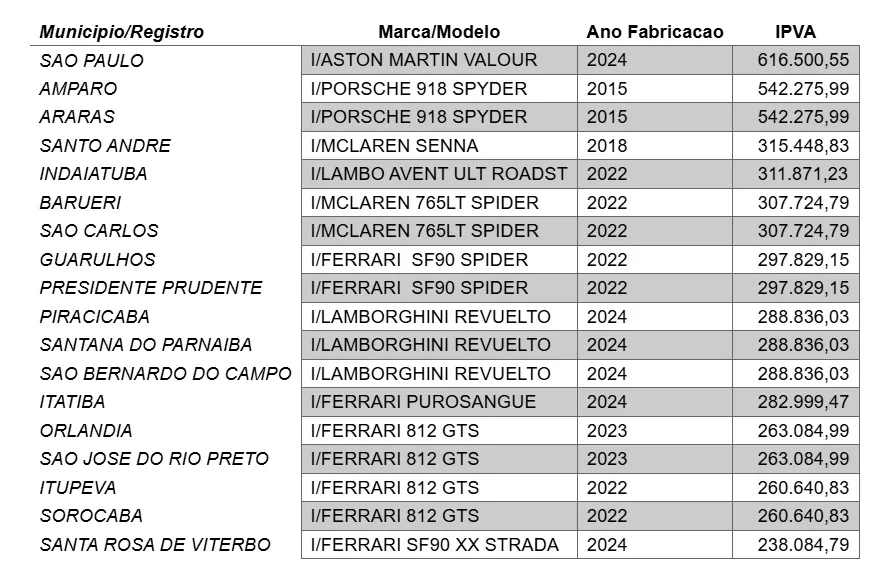

Check out the cars that will pay the most IPVA in SP:

Why is the IPVA so high for these models?

O IPVA (Tax on Motor Vehicle Ownership) in Brazil it is calculated based on the market value of the vehicle, using a rate that varies according to the state. In São Paulo, the rate for gasoline or flex vehicles is 4%. This means that the higher the price of the car, the higher the tax will be.

In addition, factors such as exclusivity, high import prices and additional taxes in Brazil make supercars even more expensive. For these models, the value of the Annual IPVA can easily exceed the price of average cars.

Impact and Reflections

If on the one hand it is surprising to see such high values, on the other it is a reflection of inequality in Brazil. Aston Martin Valor and the other vehicles on the list are symbols of status and purchasing power, but they also raise questions about the application and distribution of IPVA in the country.

While the tax collected should be used in areas such as infrastructure and urban mobility, many drivers still face poor roads and traffic problems. This generates a debate about the efficiency in the application of resources.

Final considerations

You who are reading this article probably won't have to pay R$ 616,500.55 IPVA this year. Still, understanding how vehicle taxation works in Brazil helps us reflect on the weight of taxes in everyday life, whether for popular cars or the most luxurious.

For supercar owners, the IPVA tax is just another detail amidst luxury. For most Brazilians, however, the relationship with the tax is quite different, and the impact on the family budget is significant. So the next time you hear about a car's IPVA, Aston Martin Valor, remember how fascinating — and unequal — the automotive world can be.

How about exploring more about the world of supercars and their economic impacts? Stay tuned for upcoming articles and share this content with anyone you think will be surprised by these numbers!